The rise of Bitcoin starts, breaking through several levels of resistance. It has now hit the impressive level of $70,000. The BTC price has not been this high since December 2021. It looks like 2024 will be the year of Bitcoin.

Bitcoin is getting stronger for a number of reasons. For example, since the Spot Bitcoin ETF was just passed, its volume has gone through the roof and now stands at $3.24 billion. The price is also predicted to go up even more when Bitcoin is split in half in 2024.

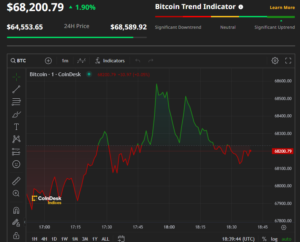

An in-depth look at Bitcoin’s technical charts

As you can see from the attached screeshot of Bitcoin from CoinDesck [you can check it live here] at one time BTC went upto $68,000.

Mainly it is expected to rise due to the upcomming April halving. [Read more about it here]

Another reason is that more investors are buying it since they expect its rise soon. Hopefully they won’t dump it very soon.

What Caused the Bitcoin Rise

Several things have led to this, including the arrival of Bitcoin in the US market, hopes that interest rates will be lowered, and the popularity of the Spot Bitcoin ETF.

Since exchange-traded funds (ETFs) that hold bitcoin became legal in the US, the longest and most valuable crypto by market value has recently gained steam.

The amount of trading in many funds went up a lot on February 26, and firms that deal with crypto also saw a big rise.

Investors also think that the US Federal Reserve may be done raising interest rates and will soon start lowering them. They are now moving their money to risky assets like Btc and lesser cryptocurrencies like Dogecoin and Ether.

A note from JPMorgan’s Nikolaos Panigirtzoglou to CNBC said that the renewed interest was due to three main things: the halving of Bitcoin, the next tech update for Ethereum (which JPMorgan sees as priced in), and the potential approval of spot ether ETFs.